OCTOBER 2024

REAL ESTATE MARKET UPDATE

CONTACT US:

425-236-6777

Federal Reserve's Rate Cuts Fuel Housing Market Surge, But Affordability Challenges Persist

The Federal Reserve's decision to further reduce interest rates in September brought a welcome boost to the housing market as summer wrapped up. This move resulted in a surge of new activity, with double-digit increases in both active and new listings, while median home prices saw a modest rise. These trends reflect a delicate balance in the market—on one side, sellers continue to hold leverage, but on the other, the reduction in rates has sparked renewed confidence among buyers.

Despite this positive momentum, the issue of housing affordability remains a persistent challenge. While the rate cuts have provided some relief, interest rates are still significantly higher than they were three years ago, which continues to put pressure on buyers, particularly those entering the market for the first time. The current 30-year fixed mortgage rate, hovering around 6.08%, is more than double the rate seen in 2021, when it was just 3.01%.

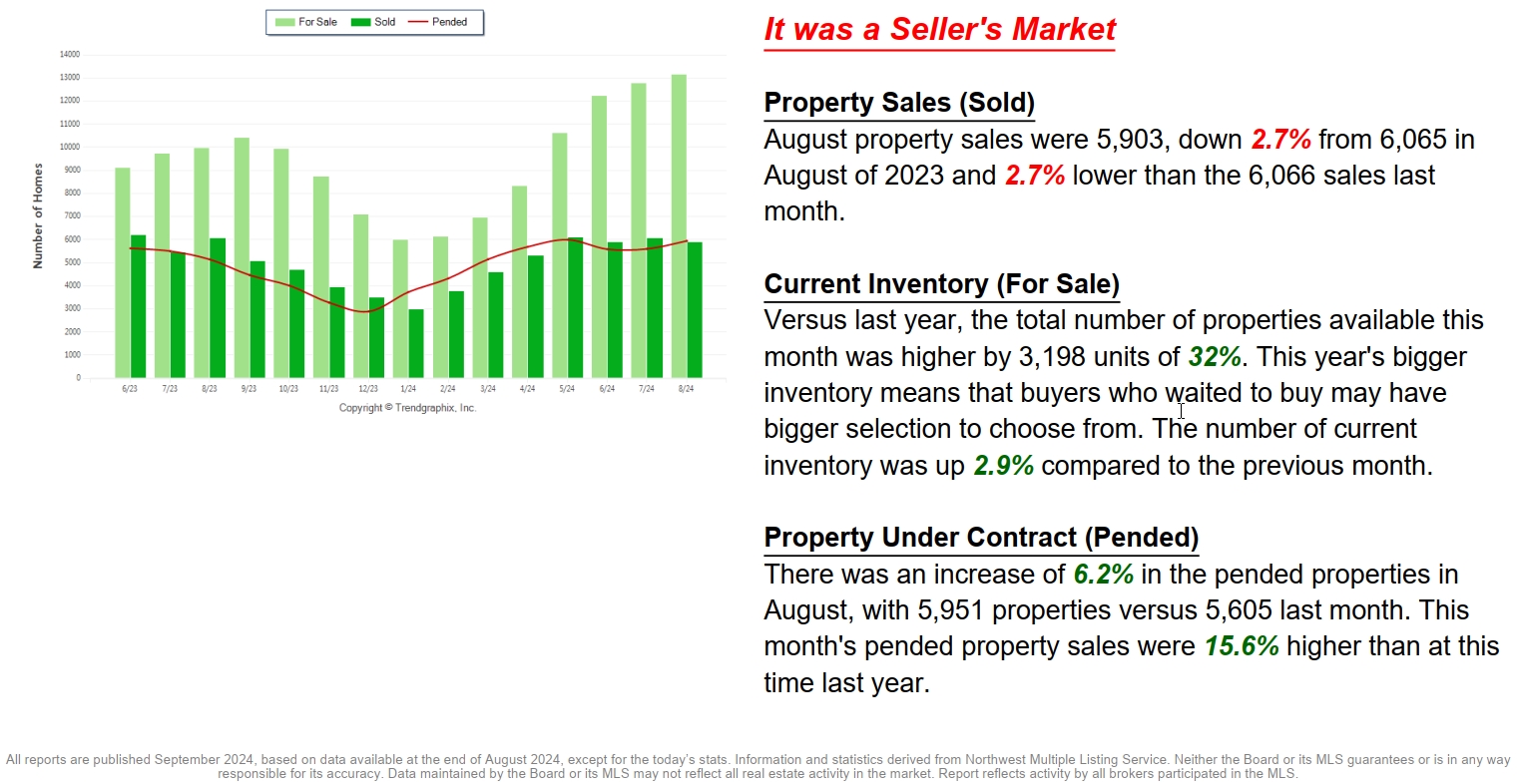

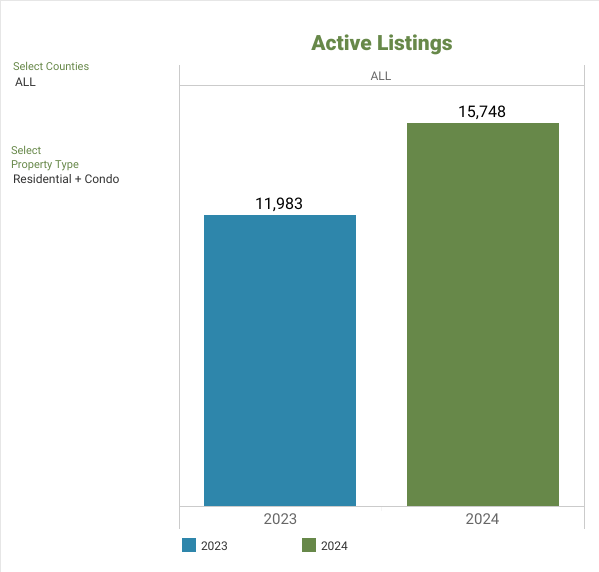

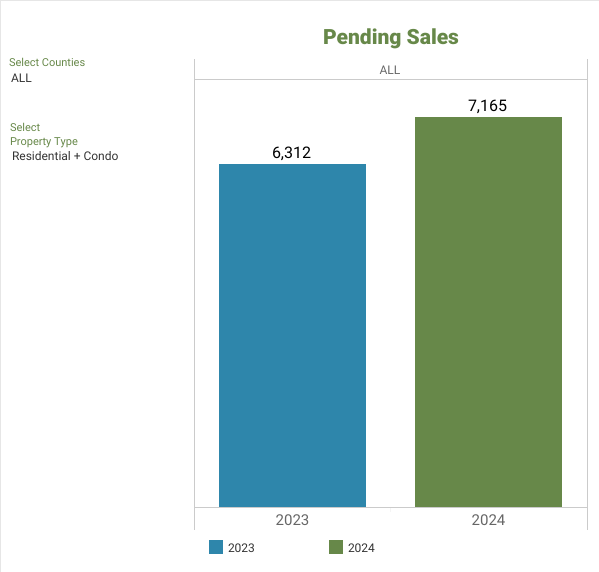

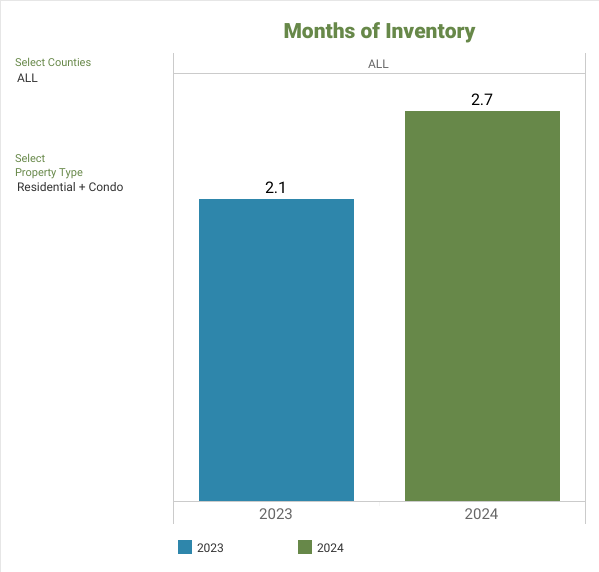

Active and new listings saw notable growth across much of the region. 22 out of 26 counties experienced double-digit year-over-year increases. The total number of homes on the market grew by more than 30%, with over 15,700 active listings available at the end of September 2024, compared to just under 12,000 in September of the previous year. In addition, new listings rose by nearly 13%, as brokers added over 8,500 new properties in September 2024, compared to around 7,550 during the same month in 2023. Some counties saw particularly large surges in inventory, with Douglas, Pacific, Clallam, Grant, and San Juan counties leading the way. Closed sales also saw a slight uptick, with a 1.9% increase from September 2023 to September 2024. While 11 counties reported more closed transactions than the previous year, 15 counties saw a decline.

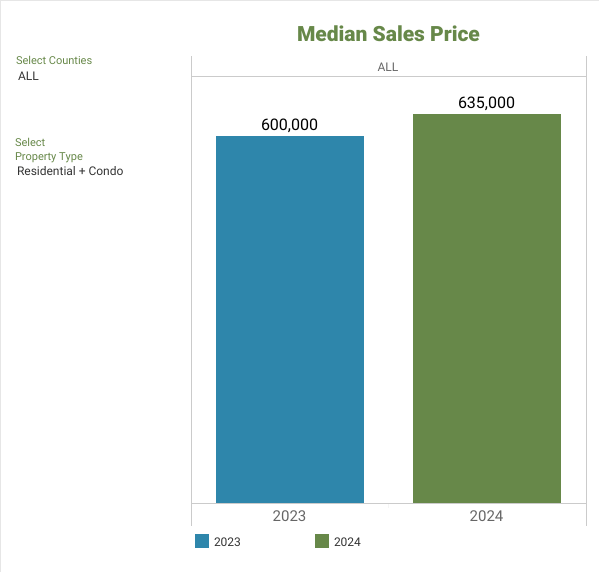

On the pricing front, the median sale price for homes and condos reached $635,000 in September 2024, reflecting a 5.8% rise compared to September 2023. King, San Juan, and Snohomish counties reported the highest median prices, while Ferry, Adams, and Columbia counties posted the lowest. As for consumer and broker activity, property showings held steady, with nearly 120,000 scheduled showings both in August and September 2024. Additionally, over 16,600 properties were eligible for the Down Payment Resource program, providing potential homebuyers with opportunities for assistance.

The Federal Reserve's decision to further reduce interest rates in September brought a welcome boost to the housing market as summer wrapped up. This move resulted in a surge of new activity, with double-digit increases in both active and new listings, while median home prices saw a modest rise. These trends reflect a delicate balance in the market—on one side, sellers continue to hold leverage, but on the other, the reduction in rates has sparked renewed confidence among buyers.

Despite this positive momentum, the issue of housing affordability remains a persistent challenge. While the rate cuts have provided some relief, interest rates are still significantly higher than they were three years ago, which continues to put pressure on buyers, particularly those entering the market for the first time. The current 30-year fixed mortgage rate, hovering around 6.08%, is more than double the rate seen in 2021, when it was just 3.01%.

Active and new listings saw notable growth across much of the region. 22 out of 26 counties experienced double-digit year-over-year increases. The total number of homes on the market grew by more than 30%, with over 15,700 active listings available at the end of September 2024, compared to just under 12,000 in September of the previous year. In addition, new listings rose by nearly 13%, as brokers added over 8,500 new properties in September 2024, compared to around 7,550 during the same month in 2023. Some counties saw particularly large surges in inventory, with Douglas, Pacific, Clallam, Grant, and San Juan counties leading the way. Closed sales also saw a slight uptick, with a 1.9% increase from September 2023 to September 2024. While 11 counties reported more closed transactions than the previous year, 15 counties saw a decline.

On the pricing front, the median sale price for homes and condos reached $635,000 in September 2024, reflecting a 5.8% rise compared to September 2023. King, San Juan, and Snohomish counties reported the highest median prices, while Ferry, Adams, and Columbia counties posted the lowest. As for consumer and broker activity, property showings held steady, with nearly 120,000 scheduled showings both in August and September 2024. Additionally, over 16,600 properties were eligible for the Down Payment Resource program, providing potential homebuyers with opportunities for assistance.

NWMLS Market Snapshot - SEPTEMBER 2024

George Moorhead of Bentley Properties talks about Inflations Causing Rates To Go Up and Is The Real Estate Market Crashing? Plus, Top 5 Things You Need To Look For When Getting Mortgage Rates